Have you ever felt like market movements sometimes just don't make sense? Like there's a hidden force at play, pushing prices in ways that seem a bit unnatural? Well, you're not alone, and it's almost a common feeling for many who watch the markets. Understanding accumulation distribution manipulation can really help you see things more clearly, especially as we move through May 2024.

This idea, accumulation distribution manipulation, points to how big players might quietly gather or unload assets. It's about a purposeful buildup, a collecting together of things over time, as my text puts it. Just like a large accumulation of snow can mean a day off, a big accumulation of shares might signal a coming price change. This collecting together of things over a period of time is a key part of how markets work, or rather, how they are sometimes influenced.

So, we'll talk about what this idea means, how it might happen, and why paying attention to it can be helpful for anyone involved with financial assets. It's a way to perhaps better understand the ebb and flow of asset prices, you know, beyond just the headlines.

Table of Contents

- What is Accumulation Distribution Manipulation?

- How Accumulation Distribution Manipulation Happens

- Why Spotting This Matters to You

- Spotting the Signs of Accumulation Distribution Manipulation

- Protecting Yourself from Manipulation

- Frequently Asked Questions

What is Accumulation Distribution Manipulation?

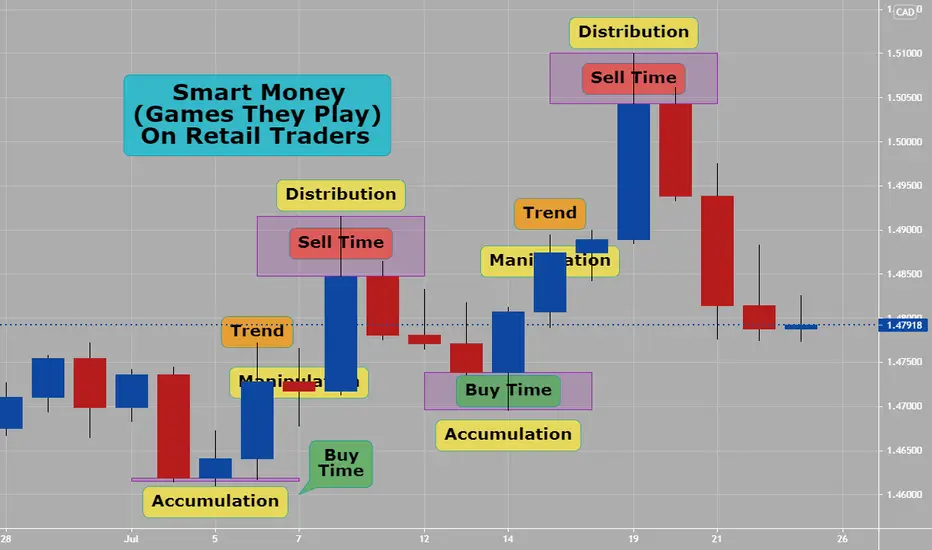

At its heart, accumulation distribution manipulation refers to the deliberate actions taken by powerful market participants. These could be big institutions or very wealthy individuals. They aim to move the price of an asset in a way that helps their own goals. This is usually done by quietly buying up a lot of something, which is the "accumulation" part, or selling off a lot, which is the "distribution" part.

My text helps us think about accumulation as a "gathering or increase of something over time." It's like a slow, steady collecting together of things. In the market, this means buying shares without making the price jump too much. The goal is to build up a large amount of something, perhaps shares, at a good price. They want to avoid attracting too much attention, so they don't drive the price up against themselves while they are still buying.

Distribution is just the opposite. It's the careful unloading of those collected assets. This is also done without causing the price to crash too fast. They want to sell their large amount of holdings at a good price, so they spread out their sales. This whole process is often done in a way that tries to trick other market participants into making moves that benefit the manipulators. It's about controlling the flow, you know, of buying and selling pressure.

This kind of activity is not always easy to see. It often happens behind the scenes, using various methods to keep it quiet. It's basically about creating a false sense of supply or demand. This makes others react in predictable ways. It's a bit like setting a trap, in a way, for less informed buyers or sellers.

How Accumulation Distribution Manipulation Happens

The way accumulation distribution manipulation plays out can take many forms. Typically, it involves a few key steps, sometimes spread out over a long period. First, during the accumulation phase, large players begin to buy a significant amount of an asset. They do this slowly, perhaps using many different accounts or brokers. This helps them avoid creating a sudden spike in demand that would push prices up too quickly against them.

They might, for instance, place small buy orders throughout the trading day. This makes their purchases look like regular market activity. It's a gathering of assets, you know, a slow collection. My text describes accumulation as "the act of gathering or amassing, as into a heap or pile." This perfectly describes how they build their position, little by little.

Once they have built up a large holding, they might then try to get others interested in the asset. This could involve spreading positive news or rumors. They might even make a few larger, visible purchases to draw attention. The idea is to create excitement, so other people start buying too. This helps to push the price higher, making their already accumulated holdings worth more. It's about creating a buzz, you know, a sense of opportunity.

Then comes the distribution phase. As the price rises, often fueled by other people's buying, the manipulators start to sell their assets. They do this carefully, just like they bought. They sell in small amounts, making sure not to flood the market. This prevents the price from falling sharply before they've finished selling all their shares. They want to unload their "heap or pile" of assets at the highest possible price.

Sometimes, they might even use short selling to push prices down after they've distributed their holdings. This can make the asset seem weaker than it is. It creates a feeling of panic, making others sell at lower prices. This whole cycle is about taking advantage of how people react to market signals. It's a bit of a clever dance, really, between buying, building interest, and then selling off.

This process often relies on market psychology. They want to influence how people think and feel about an asset. They might use news events or even create fake news to achieve their goals. It's a pretty calculated approach to moving prices. So, it's not just random ups and downs, but sometimes a planned effort.

Why Spotting This Matters to You

Knowing about accumulation distribution manipulation is pretty important for anyone who buys or sells assets. If you can spot these moves, you might avoid getting caught in a bad situation. Think about it: if big players are quietly accumulating, it could mean they expect the price to go up. If they are distributing, it might suggest they think the price will go down soon. This knowledge can give you a bit of an edge, you know, in your own decisions.

For regular folks, getting caught in these cycles can mean losing money. You might buy an asset when the manipulators are trying to get rid of theirs. Or you might sell when they are secretly buying it up. This is why understanding the "gathering or increase of something over time" in market assets is so key. It helps you see beyond the surface, really.

It's about protecting your own resources, too it's almost about being smart with your money. If you can see the signs, you might avoid buying at the peak, or selling at the bottom. This can help you make more informed choices. It's a way to be more prepared, frankly, for what the market might do next. This insight can help you stay out of trouble, which is always a good thing.

Knowing about these tactics also helps you be more skeptical of sudden price moves or news stories. Not everything you see in the market is what it seems. Sometimes, there's a bigger plan at work. So, being aware of accumulation distribution manipulation helps you question things. This makes you a more careful and thoughtful participant in the market. It’s about being a bit more street smart, you know, with your investments.

Spotting the Signs of Accumulation Distribution Manipulation

Identifying accumulation distribution manipulation isn't always simple, but there are some signs to look for. It often involves watching how volume and price behave together. These clues can give you hints about what the big players are doing behind the scenes. It's about looking for patterns that don't quite fit the normal flow of things.

Volume Clues

Volume, which is the number of shares traded, can tell a big story. During accumulation, you might see rising prices with low volume. Then, perhaps, when prices drop a little, you see high volume. This can suggest that big players are buying quietly on dips. My text talks about accumulation as a "collecting together of things over a period of time." This slow, steady buying often doesn't create huge volume spikes on up days.

Conversely, during distribution, you might see high volume on days when the price goes down. This could mean big players are selling into any strength. They might also sell on days with small price gains but high volume. This indicates they are unloading their assets while others are still buying. It's about watching where the actual buying and selling pressure is, really.

- Low volume on price increases: This can mean there isn't much real buying interest from the wider public. It might be manipulators pushing prices up with small buys to attract attention.

- High volume on price declines: This often suggests strong selling pressure. It could be big players getting rid of their holdings.

- Volume spikes without clear price direction: This can indicate a struggle between buyers and sellers. It might be accumulation or distribution happening under the surface.

Price Action Patterns

The way an asset's price moves can also give clues. During accumulation, you might see the price stay within a narrow range for a while. It might even drop a bit, only to quickly recover. This sideways movement, or a slow upward drift, can be where the "gathering or increase of something over time" is happening. Big players are buying up shares without letting the price run away from them.

For distribution, the price might also stay in a range. However, it will often show weakness at the top of that range. There might be quick drops that recover, but then the price fails to make new highs. This suggests that sellers are stepping in whenever the price rises. It's a bit like hitting a ceiling, you know, that the price just can't break through.

- Tight trading ranges: These periods can be prime times for accumulation or distribution. Prices move sideways as big players build or unload positions.

- False breakouts or breakdowns: A price might briefly move above a resistance level or below a support level, then quickly reverse. This can be a tactic to trick others into buying or selling.

- "Shakeouts": Sharp, quick price drops that scare out smaller investors, only for the price to recover. This is often a sign of accumulation, as manipulators buy up shares from fearful sellers.

News and Sentiment Disconnects

Sometimes, the market's reaction to news just doesn't seem right. If really good news comes out, but the asset's price doesn't go up much, or even falls, that's a red flag. This can suggest distribution is happening. Big players are selling into the positive news. They are using the excitement to unload their "heap or pile" of assets. This is a pretty common tactic, actually.

Similarly, if bad news comes out, but the price holds steady or even rises, it might be accumulation. Big players could be buying up shares from those who are scared by the news. They are gathering assets while others are panicking. It's a way to get good prices. So, it's about watching if the market's reaction matches the news, or if it seems off.

- Positive news with little price movement or a drop: This could signal distribution, as large holders sell into the hype.

- Negative news with little price movement or a rise: This might indicate accumulation, as big players buy from fearful sellers.

- Sudden, unexplained surges or drops: These can be attempts to trigger stop-loss orders or create panic, benefiting manipulators.

Protecting Yourself from Manipulation

While you can't stop accumulation distribution manipulation from happening, you can definitely protect yourself. Being aware is the first step, as we've talked about. But there are also practical things you can do to avoid becoming a victim. It's about being prepared and making smart choices, you know, for your own financial well-being.

Here are some ways to keep yourself safer:

Do Your Own Homework: Don't just follow the crowd or listen to every rumor. Really dig into the asset you're interested in. Look at its fundamentals, its long-term prospects. This independent research helps you make decisions based on value, not just short-term price movements. It's about having your own reasons for buying or selling.

Look at the Bigger Picture: Don't focus only on daily price changes. Step back and look at charts over weeks, months, or even years. This helps you see the broader trends and whether current moves fit into a larger pattern of "gathering or increase of something over time" or distribution. A longer view often reveals more, you know, about what's really going on.

Use Stop-Loss Orders Wisely: These orders automatically sell your asset if it drops to a certain price. They can limit your losses if a manipulation attempt goes against you. However, be careful where you place them. Sometimes, manipulators try to trigger these orders to buy up shares cheaply. So, place them strategically, perhaps not at obvious round numbers.

Be Skeptical of Hype: If everyone is suddenly talking about a certain asset, and the price is soaring, be cautious. This could be the distribution phase. Big players might be using the hype to unload their positions. It's often better to be early than to chase a rapidly rising price. Hype can be a sign that the "collecting together of things" is about to reverse.

Consider Diversifying: Don't put all your eggs in one basket. Spreading your assets across different types of investments can reduce your risk. If one asset is being manipulated, it won't affect your entire portfolio as much. This is a pretty basic but very powerful protection, really.

Learn More: Keep educating yourself about market dynamics and different trading strategies. The more you know, the better equipped you are to spot unusual activity. Learn more about market trends and analysis on our site, and link to this page about accumulation distribution for more details. Continuous learning is a key part of staying ahead. It's about building your own knowledge, so you can see things clearly.

Frequently Asked Questions

People often have questions about how these market movements work. Here are some common ones:

What is the difference between accumulation and distribution?

Basically, accumulation is when big buyers are slowly gathering a lot of an asset. They are building up a "heap or pile" of it, as my text describes. Distribution is the opposite. It's when those big holders are carefully selling off their large amount of assets. Both are done in a way that tries to avoid big price swings, so they can get the best deals for themselves.

Is accumulation distribution manipulation illegal?

Well, it's a bit complicated. Intentional manipulation that tricks or defrauds investors is indeed illegal in many places. However, large institutions naturally buy and sell huge amounts of assets. This can look like accumulation or distribution. The key is whether they are actively trying to mislead the market. Proving illegal intent can be very hard, you know, in a court of law.

How long does accumulation or distribution typically last?

The time frame can vary a lot. It might last for a few weeks, or it could stretch out over many months. It really depends on the size of the position being built or sold, and how liquid the asset is. Less liquid assets might take longer to accumulate or distribute without causing big price changes. It's often a slow process, a gathering over time.

Understanding accumulation distribution manipulation can really change how you see the market. It helps you look beyond the obvious. It gives you a way to think about what big players might be doing. By paying attention to these signals, and staying informed, you can make more thoughtful decisions with your own assets. So, keep learning, and keep watching those patterns.