Considering whether the Chartered Financial Analyst® (CFA®) program holds its weight in today's fast-paced finance world is a big thought, you know. Many folks wonder if putting in the time and effort for this credential truly pays off. It is a commitment, after all, and you want to be sure it makes sense for your future.

The finance industry keeps changing, with new technologies and ways of doing things coming up all the time. So, it is natural to ask: is CFA still worth it? What kind of benefit does it bring to someone's career path these days?

This article will look at what the CFA program gives you, how it helps your career, and what you need to put in to get it. We will talk about why it still matters, even now, and give you some things to think about as you make your own choice, so.

Table of Contents

- The CFA Program: What It Offers

- Why Consider the CFA Today?

- What It Takes: Prerequisites and Commitment

- Common Questions About the CFA Program

- Making Your Decision About the CFA

The CFA Program: What It Offers

The CFA program is, in a way, a path to becoming a financial analyst who is known all over the world. It is a set of steps you take to learn and show what you know about money matters. People who finish it get the CFA® designation, which is pretty well respected, as a matter of fact.

A Globally Known Designation

One of the main things the CFA program does is give you a mark of quality that people recognize everywhere. By promoting the very best levels of ethics, learning, and skill, it helps people in the financial world. This means that when you have the CFA, people in different countries usually know what that means about your abilities, you know.

It is a way to show that you meet certain standards, which is quite important in a field that crosses borders. This global recognition can open doors to work chances in many places. It is, like, a universal language for financial professionals, so.

A Strong Foundation in Finance

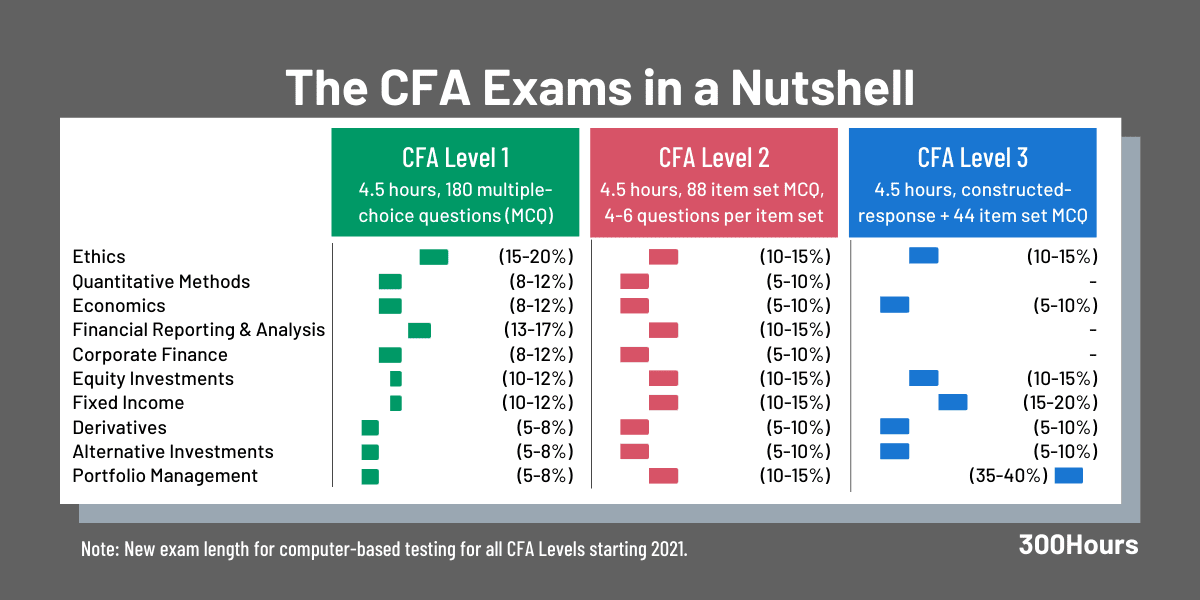

The CFA program curriculum gives you a broad base of knowledge. It has three levels, and each one builds on the one before it, so you are always adding to what you know. This is a program that tests what financial analysts understand and what they can do, basically.

You learn about things like how markets work, how to value companies, and how to manage money for others. The program also covers how to think about investments at every stage of your working life, which is very helpful. You can find out more about the CFA program curriculum overview on our site, which includes information on Levels I, II, and III topics, PSM details, and useful insights to support your study.

For instance, the Level I exam covers its own structure, what topics are in it, and tips for doing well. This structured way of learning helps you get a good grasp of the whole picture. It is, kind of, like building a house brick by brick, you know, each piece supports the next.

A Digital Learning Approach

To help you study, the CFA program has something called the Learning Ecosystem (LES). This is a tool that is all on the computer. It is there to help you learn more effectively, which is pretty neat.

The LES gives you materials and ways to practice that fit with how you learn best. It is a good way to get ready for the exams and keep track of your progress. This kind of tool shows that the program is trying to keep up with how people learn these days, too it's almost.

Why Consider the CFA Today?

The world of finance is always changing, so people often ask if the CFA still matters. The answer is, yes, it usually does. It offers several benefits that stay true even as the industry shifts, that.

Career Growth and Recognition

Having the CFA designation can really help your work life. It shows that you have a deep understanding of finance, and that you are serious about your work. This can make you stand out when you are looking for a job or trying to move up in your current one, apparently.

Many employers in finance look for people with the CFA because it means they have a solid education and a strong sense of right and wrong. It can give you an edge over others who do not have it. This is a pretty big deal for many people who want to move ahead, you know.

Ethical Standards and Trust

A very important part of the CFA program is its focus on doing things the right way. It promotes the very highest levels of ethics. In finance, trust is everything, and the CFA program really pushes for people to act with integrity.

This commitment to good behavior is something that clients and employers truly value. It helps build confidence in the financial markets, which is good for everyone. So, it is not just about what you know, but also about how you act, in a way.

Staying Current in a Changing Industry

The financial world does not stand still, and neither does the CFA program. The curriculum is updated to keep up with new ideas and practices. This means that what you learn is still relevant to what is happening right now, which is quite important.

The program helps people improve their investment knowledge at every point in their working lives. This focus on ongoing learning helps you stay useful and valuable in a field that keeps moving forward. It is, like, a way to keep your skills fresh, basically.

What It Takes: Prerequisites and Commitment

Getting the CFA designation is not something you do overnight. It asks for a real commitment of your time and effort. Knowing what you need to start and what you will have to put in is important before you decide if is CFA still worth it for you, so.

Getting Started with the Program

There are certain things you need to have or do before you can even begin the CFA program. This includes your schooling background and any work experience you have. The program gives clear outlines of what is needed to get going, you know.

You can learn about the requirements and qualifications needed to start the CFA program. They lay out the main things, from your school history to what you have done in the work world. It is a good idea to check these things first to make sure you are ready, apparently.

The Investment of Time and Money

The CFA program takes a lot of study time. Each level of the curriculum builds on the one before it, which means you are always learning more and more. This means many hours of hitting the books and practicing, which is pretty much the way it goes.

There are also fees involved, including registration and exam costs. You can find information about these fees, as well as early bird dates, all in one spot. It is good to have a clear idea of the financial side of things before you start, as a matter of fact. It is a big commitment, for sure.

Common Questions About the CFA Program

People often have similar questions when they are thinking about the CFA program. Let us look at a few of these, just a little.

Is CFA still relevant in 2024?

Yes, many people feel the CFA is still very much relevant in 2024. The core ideas of finance and investment management do not really change that much, even with new tools and ways of doing business. The program’s focus on ethics, a deep understanding of financial tools, and investment strategies remains important.

It is still a strong sign to employers that you have a solid base of knowledge and a commitment to doing things the right way. The fact that the curriculum gets updated also helps keep it current with what is happening in the industry. So, in some respects, its value has held up well.

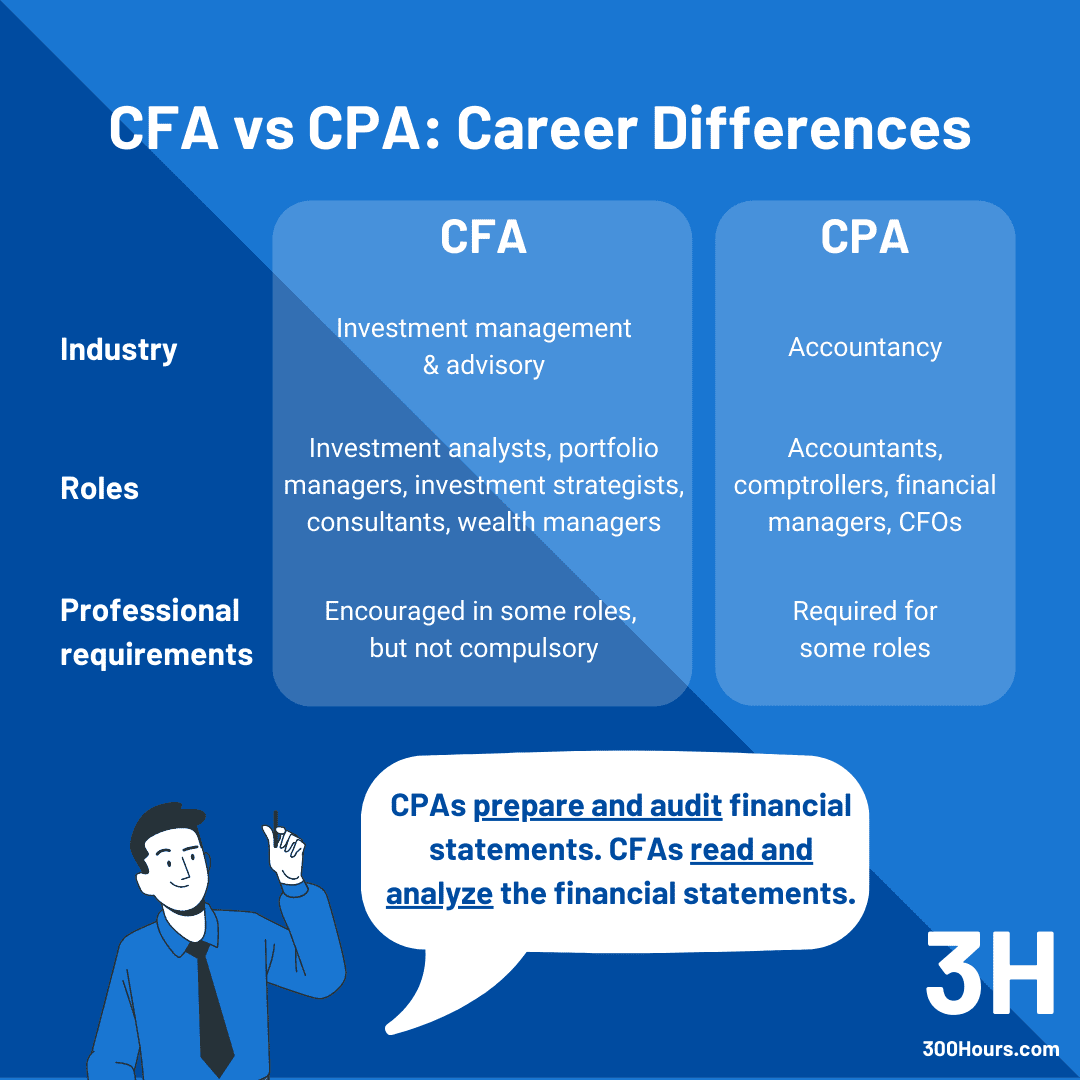

What jobs can I get with a CFA?

People with the CFA designation work in a lot of different roles in the financial world. You might find them as portfolio managers, who look after money for others. They also work as research analysts, studying companies and markets.

Other roles include risk managers, who look at potential problems, or investment consultants, who give advice. People with a CFA also work in wealth management, helping individuals with their money. The skills you get from the program can apply to many parts of the finance industry, you know. To get a better sense of where you might fit, you could even try their 2-minute learning compass quiz to see which CFA Institute program might be perfect for you.

How much does a CFA increase salary?

It is hard to give an exact number for how much a CFA increases someone's pay, because it depends on many things. These include your location, your specific job, how many years you have been working, and the kind of company you are with. However, generally speaking, people with the CFA designation often earn more than those without it in similar roles.

The CFA can help you get better jobs or move up in your current one, which often comes with higher pay. It shows a level of skill and dedication that employers are willing to pay for. So, while there is no fixed amount, it usually helps you earn more over your working life, pretty much.

Making Your Decision About the CFA

Thinking about whether is CFA still worth it for you means looking at your own goals and what you are willing to put into it. The program offers a globally recognized mark of skill, a strong base of financial knowledge, and a commitment to doing things ethically. It can definitely help you move forward in your career and open up new chances.

While it asks for a lot of time and money, many people find that the benefits make it a worthwhile choice for their future in finance. It is a personal choice, of course, but knowing what the program gives you and what it asks of you helps a lot. Learn more about the CFA program level I exam on our site, including its structure, topic outlines, and exam tips.